Introduction

The world of cryptocurrency is full of surprises—one moment you could be celebrating a significant gain, and the next, you might be facing a dip that tests your confidence in the market. Just look at 2021, when the NFT market surged, with digital art selling for jaw-dropping prices, only to see those values crash shortly after.

This pattern of rapid rise followed by sharp fall is a classic tale of what we call a cryptocurrency bubble. In this article, we’ll break down what crypto bubbles are, how they form, and most importantly, how you can protect yourself and even take advantage of market’s ups and downs.

What is a Crypto Bubble?

A crypto bubble happens when the price of a cryptocurrency skyrockets, often well beyond what it’s really worth. This surge is usually fueled by speculation and excitement rather than solid fundamentals.

Picture it like an over-inflated balloon: the more people jump on the bandwagon, the bigger it gets. But when the excitement fades and the actual usefulness of the asset comes into question, the bubble can burst, causing prices to drop sharply.

How Are Bubbles Formed?

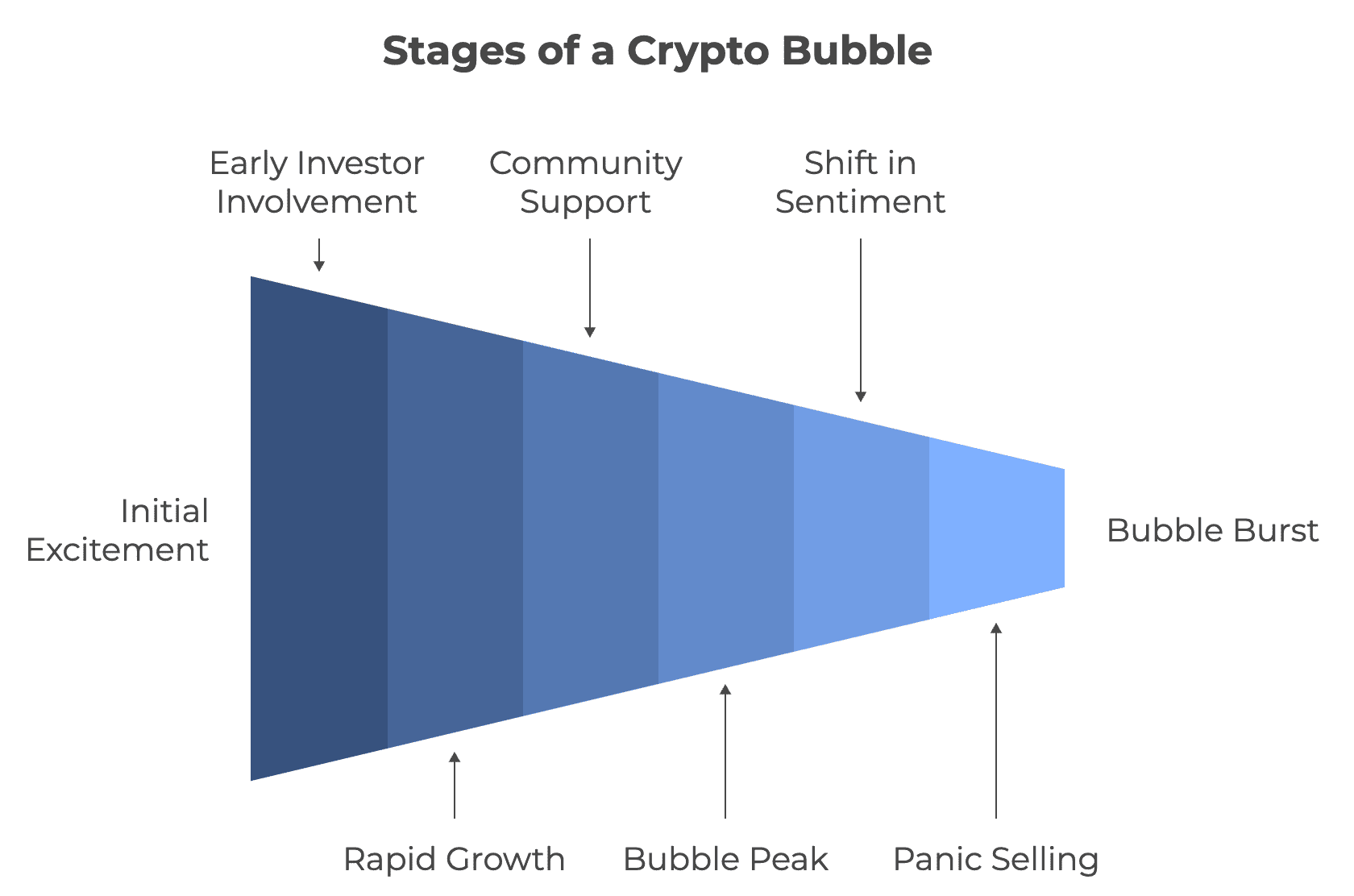

Understanding how crypto bubbles form is essential for investors. The process unfolds in several stages, each playing a critical role in the rise and fall of cryptocurrency prices. Here’s a simple breakdown:

Stage 1: Emergence and Brewing

Every bubble begins with a spark of excitement, often driven by new technology that captures people’s attention.

- Excitement from New Technology: Innovations like blockchain generate buzz as people envision countless possibilities for its application. This initial excitement draws attention from curious investors.

- Early Investors Get Involved: As the buzz grows, a small group of enthusiastic investors starts buying in and sharing their insights online. Their discussions generate more interest, inviting newcomers to explore the investment opportunities.

Stage 2: Rapid Growth and Hype

As the initial interest grows, more people begin to invest, leading to rapid price increases.

- Fear of Missing Out (FOMO): When prices rise, many rush to invest, fearing they will miss out on potential profits. This demand pushes prices even higher.

- Media Coverage Boosts Interest: As prices soar, news stories highlight success stories and significant price increase, attracting more investors. This media attention can lead to more buying, further driving up prices.

- Community Support: Online communities, such as forums and social media groups, start rallying around specific cryptocurrencies. This shared enthusiasm can amplify interest, further driving up prices as more people join the conversation.

Stage 3: Bubble Peak and Burst

After a period of rapid growth, the market reaches a tipping point where reality sets in.

- Overpriced Assets: At the bubble's peak, prices often soar well beyond the actual value of the assets. Many investors start ignoring fundamental market principles, focusing instead on speculation.

- Shift in Sentiment: As prices continue to rise, a growing number of people begin to question the sustainability of such high valuations. This shift can lead to panic selling as investors scramble to exit the market before prices fall.

- Leverage Worsens the Situation: Some investors may have borrowed money to invest, hoping to amplify their gains. When the bubble bursts, these leveraged positions can lead to rapid sell-offs, causing prices to plummet even further.

What Happens After a Bubble Bursts?

When a crypto bubble bursts, the effects can be severe and far-reaching. Here’s a concise explanation of what happens:

Market Correction

After a bubble bursts, cryptocurrency prices can plummet by 80-90%. This sharp decline results in substantial financial losses for many investors who purchased at inflated prices. Moreover, when one cryptocurrency crashes, it often triggers declines in related assets, highlighting the interconnectedness and fragility of the market.

Example: Bitcoin 2017 - The Rocket That Came Crashing Down

Investor Losses

Investors who entered the market at high prices may face significant setbacks, prompting panic selling that drives prices even lower. This creates a cycle of loss, making it difficult for remaining investors to recover. Additionally, the crash can erode trust in cryptocurrencies, causing many investors to hesitate before returning to the market.

Example: Terra Luna 2022 - When “Stable” Wasn’t So Stable

Regulatory Scrutiny

Following a crash, governments often introduce new regulations to protect investors and prevent future bubbles. These rules can lead to stricter oversight of cryptocurrency companies, which may stifle innovation. Regulators might also investigate fraudulent activities, further shaking investor confidence.

Example: ICO Craze of 2017-2018 - The Regulatory Reckoning

Technological Advancements

After a bubble, the emphasis usually shifts from speculative investments to developing valuable products and applications. This transition can create a healthier market environment, where projects focus on practical uses of blockchain technology. The downturn often encourages innovation, allowing stronger projects to thrive.

Example: NFT Market Craze 2022

Long-Term Impact

The aftermath of a bubble often leads to a market cleanup, where weaker projects fail and stronger ones persist. This process helps create a more sustainable crypto ecosystem. A crash can also increase attention on the genuine potential of cryptocurrency technology, fostering greater adoption as investors seek real-world solutions.

Example: The Altcoin Explosion of 2018 - A Gold Rush That Fizzled

Psychological Impact

The emotional fallout from a bubble bursting can leave investors feeling anxious and cautious. This fear may influence their future investment decisions, making them less likely to engage with the market. The experience of significant losses can result in a lasting distrust of cryptocurrencies, even when conditions improve.

Example: General Market Sentiment Post-Bubble

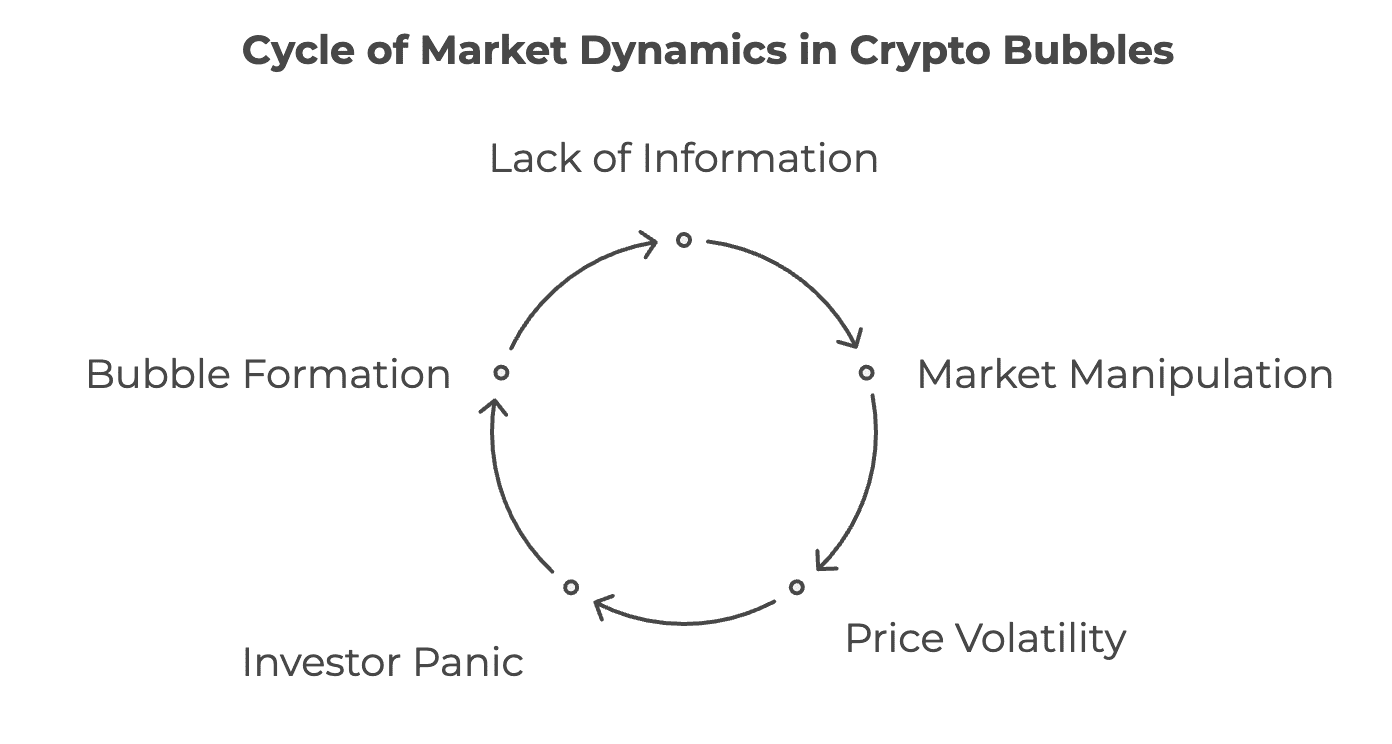

Underlying Causes of Bubble Formation

Cryptocurrency bubbles can seem complex, but they often follow a pattern where prices rise too quickly and then crash. Here’s a breakdown of the main reasons why these bubbles form, explained in simple terms:

1. Psychological Factors: How Emotions Drive Market Behavior

Emotions play a significant role in investment decisions, often leading to irrational actions that fuel market volatility.

- Fear and Greed: In the world of crypto, emotions often take the wheel. When prices soar, people rush to buy out of greed, hoping to make quick profits. On the flip side, fear of losing money can lead to panic selling when prices start to drop, causing even more volatility.

- Herd Mentality: People tend to follow the crowd, especially when they see others making money. If everyone’s buying, you might feel tempted to do the same without fully understanding the risks. This can lead to inflated prices, creating a bubble.

2. Market Mechanisms: What Happens Behind the Scenes

The dynamics of the market can create conditions that lead to unsustainable price increases.

- Lack of Information: Not all investors have access to the same information. Insiders can manipulate the market, while regular investors may drive prices higher based on incomplete data, creating an unstable environment.

- Market Manipulation: Sometimes, big players with a lot of money can influence the market. They can buy large amounts of a coin to drive up the price or sell to cause panic. This manipulation can make prices rise or fall rapidly, adding to the creation of bubbles.

3. External Factors: The Bigger Picture

Broader economic and regulatory factors can heavily influence cryptocurrency markets.

- Government Regulations: Rules and regulations from governments can have a big impact on the market. If new laws make crypto trading more difficult or risky, prices can fall. On the other hand, friendly regulations can boost confidence and drive prices up.

- Economic Conditions: Things like inflation, interest rates, and the overall economy play a role. When inflation is high, for example, people might seek out alternatives like cryptocurrencies, driving up prices.

4. Technological Factors

Innovations in technology can spark excitement and lead to speculative investments. Every time a new crypto technology or platform comes out, people get excited. They invest heavily in hopes of getting in early on the next big thing. This rush to invest can lead to bubbles, as everyone piles in before fully understanding the risks.

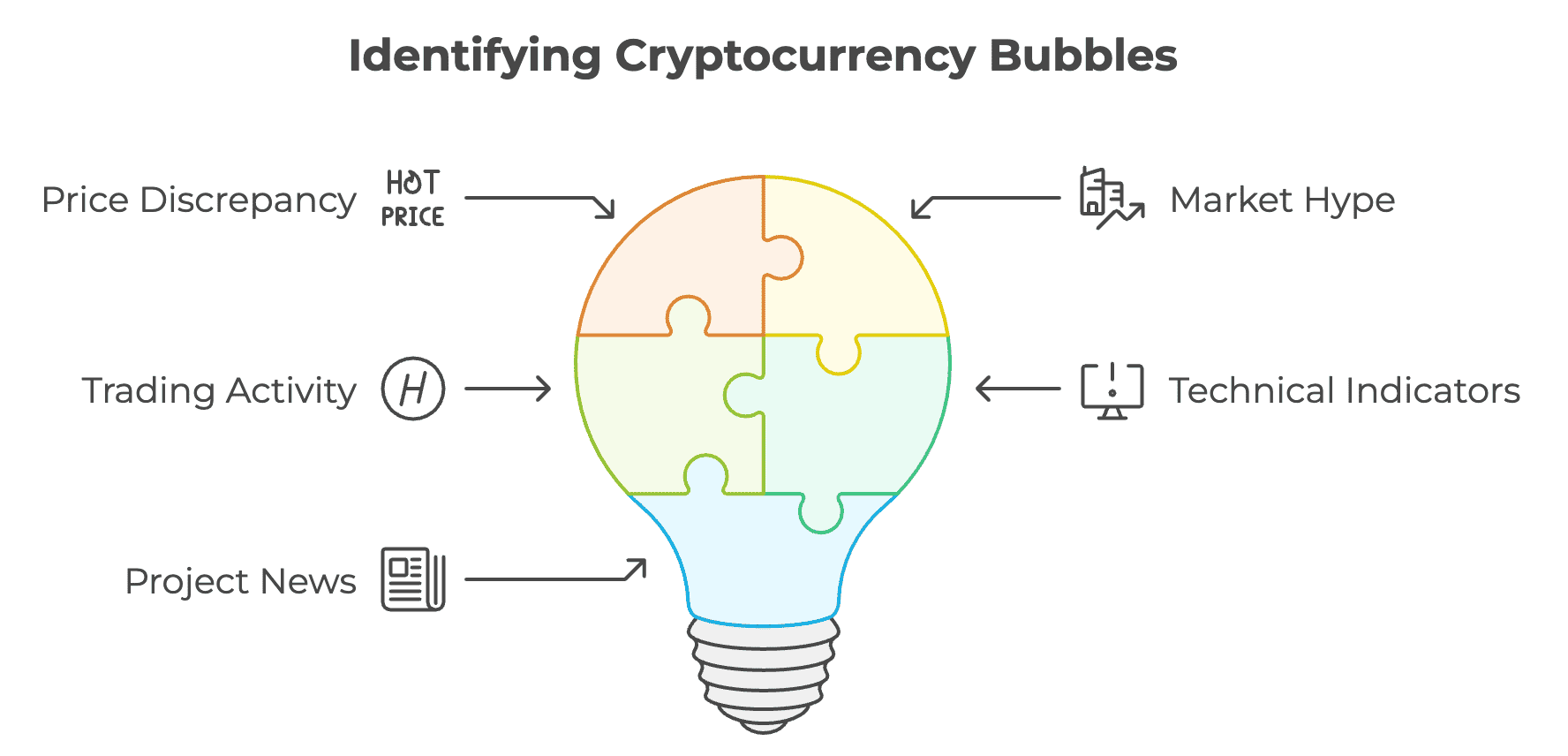

How to Spot Warning Signs in Cryptocurrency?

The world of cryptocurrency is exciting but notoriously unpredictable. Prices can shoot up fast, and just as quickly, they can crash. So, how do you know if a bubble is forming and when it's time to be cautious? Let’s break it down into the most important things to watch for.

1. When Prices Don't Match the Project's Value

If a cryptocurrency's price skyrockets without real progress, it’s a major red flag. Ask yourself: Has the project made significant advancements, or is it all hype? Overhyped projects often lack solid business plans or experienced teams, making them vulnerable when the market corrects itself.

2. The Hype Machine: Overexcited Markets

Have you noticed everyone buzzing about a particular coin? While excitement can drive interest, too much hype is often a warning sign. When social media is flooded with wild predictions and celebrity endorsements, it’s easy to feel left out. FOMO (Fear of Missing Out) can push you into making hasty investment decisions based solely on excitement rather than careful research, which may inflate prices unsustainably.

3. Unusual Trading Activity

Keep an eye on trading patterns. A sudden spike in trading volume can be a clue that something unusual is afoot, possibly even market manipulation. If just a few large trades can significantly move a coin’s price, it indicates that the market may be more fragile than it appears.

4. Technical Warning Signs

Certain technical indicators can signal trouble ahead. Tools like the Relative Strength Index (RSI) can help you identify overbought conditions, which often precede a price drop. Additionally, bearish patterns, such as the “death cross,” typically suggest that a market downturn may be imminent. Being aware of these signs can help you make more informed decisions.

5. Bad News From the Project

Bad news from a cryptocurrency project can quickly shake investor confidence. Keep an eye out for issues like team departures, major technical flaws, or legal troubles—these developments can lead to significant price declines. A strong project relies on a solid team and sound technology; if either falters, so may the price.

How to Prepare for a Crypto Bubble Burst?

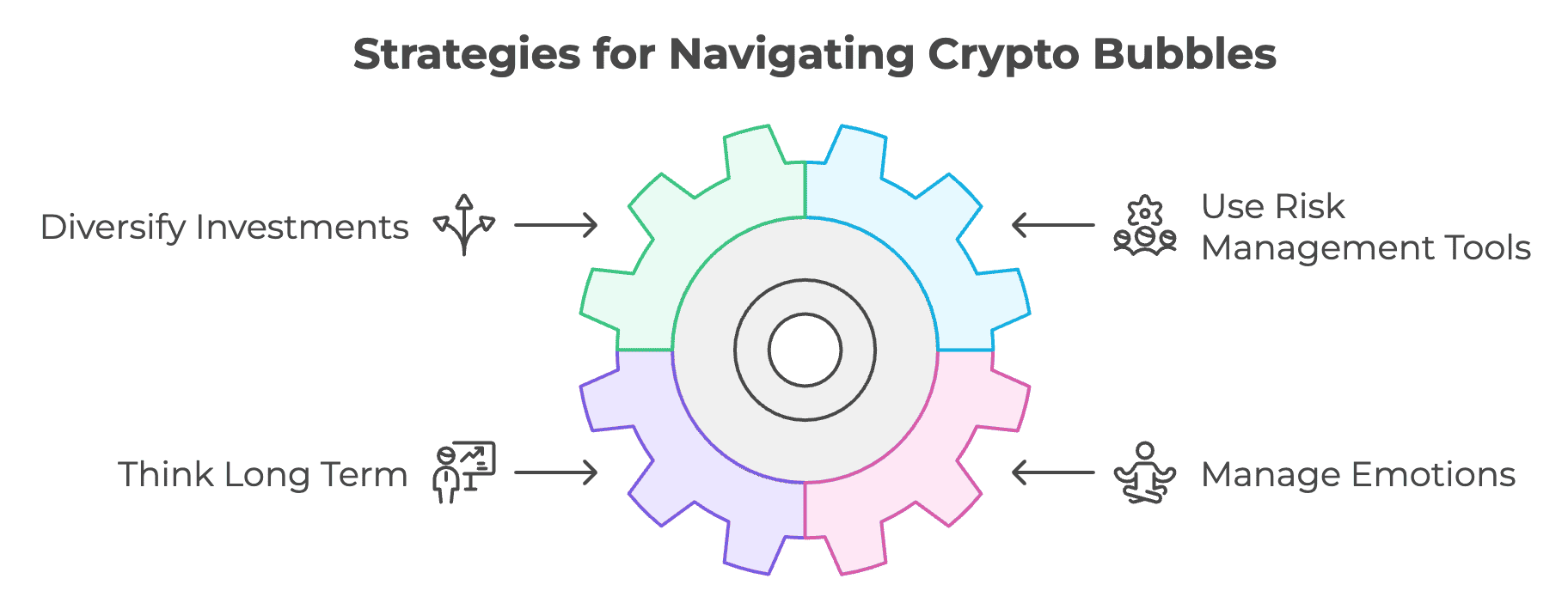

Navigating the ups and downs of the cryptocurrency market can feel like a rollercoaster, especially when faced with a potential bubble burst. While you can’t predict exactly when the market will take a downturn, being prepared can help you minimize losses and make more informed decisions. Here’s how to protect yourself in such a volatile environment:

Diversify Your Investments

Don’t put all your money into cryptocurrencies. Spread your investments across different asset classes like stocks, bonds, and real estate. This way, if the crypto market crashes, you won’t lose everything. Even within the crypto space, invest in different coins and projects. By doing this, poor performance from one cryptocurrency won’t wipe out your entire portfolio.

Use Risk Management Tools

Tools like stop-loss orders can help you control your losses. These are automatic triggers that sell your crypto if its price drops below a certain point. You can also explore options like futures or other derivatives that allow you to hedge your bets, offering some protection in case the market crashes.

Think Long Term

Crypto markets can be extremely volatile, so it’s important to look at the big picture. Instead of chasing quick profits, focus on projects with strong fundamentals and long-term potential. Avoid getting sucked into the day-to-day price swings, and remember that patience can pay off in the long run.

Manage Your Emotions

Don’t let the fear of missing out (FOMO) push you into making rash decisions. Stick to your investment strategy, and avoid getting swept up in market hype or panic. Emotional decisions are often the wrong ones in investing.

Frequently Asked Questions (FAQ)

What are the early warning signs of a crypto bubble?

Key warning signs of a crypto bubble include rapid price surges far exceeding a project's intrinsic value, overheated market sentiment driven by excessive optimism on social media, unusual spikes in trading volume that may suggest manipulation, and a disconnect between price and the cryptocurrency's fundamental support.

How can technology help reduce risk during volatile markets?

Technology can mitigate risk in volatile markets through automated trading tools like stop-loss orders, real-time data analytics that offer insights into market trends, blockchain transparency for tracking asset movements, and AI predictive models that analyze historical data to anticipate market shifts.

What long-term effects do bubbles have on cryptocurrency?

Bubbles can lead to long-term effects such as market consolidation, where weaker projects fail and stronger ones thrive; increased regulatory scrutiny resulting in tighter regulations; a renewed emphasis on building real-world utility; and lasting psychological impacts that may instill fear and reluctance among investors in the cryptocurrency space.