Introduction

Ever wonder how a single trade can send cryptocurrency prices soaring or crashing in the blink of an eye? Enter the world of crypto whales—the powerful players who hold massive amounts of digital assets and have the ability to move markets with a few clicks. Just like real whales dominate the ocean, these market giants can create waves that affect the entire cryptocurrency ecosystem.

This article will delve into the world of crypto whales, exploring their strategies, impact on the market, and how you can navigate these turbulent waters as an investor. We'll uncover their tactics, analyze their influence on different types of cryptocurrencies, and provide practical tips for navigating whale-driven markets.

What Exactly Are Crypto Whales?

A "crypto whale" refers to individuals or entities that hold a significant amount of a particular cryptocurrency, with their transactions large enough to influence prices. The threshold for being considered a whale varies by cryptocurrency.

For instance, anyone holding 1,000 BTC or more (worth millions of dollars) is often classified as a whale. In smaller cryptocurrencies (altcoins), even a few hundred thousand tokens could qualify due to lower overall supply and market activity.

Types of Crypto Whales

Crypto whales fall into several categories, each with distinct characteristics and market behaviors:

1. Individual Whales

These are high-net-worth individuals or early adopters of cryptocurrency who have accumulated large amounts over time. They often have long-term investment strategies and may not frequently trade their holdings, contributing to market stability.

Market Behavior:

2. Institutional Whales

These are big players like hedge funds, investment companies, or corporations that invest large sums into cryptocurrencies. When they get involved, it makes cryptocurrencies more accepted as a serious investment.

Market Behavior:

3. Exchange Whales

Cryptocurrency exchanges hold large amounts of digital assets on behalf of their users. Their policies regarding trading can significantly impact market liquidity and price movements.

Market Behavior:

4. Anonymous Whales

Some whales operate under pseudonymous identities or hold assets across multiple wallets to conceal their true holdings. This anonymity can lead to unpredictable market behavior since their actions may not be easily traced.

Market Behavior:

What Crypto Whales Do in the Market?

Market Makers Vs. Market Takers

Within the cryptocurrency trading ecosystem, market makers and market takers are two essential types of participants. Each plays a distinct role in maintaining market liquidity and facilitating trades, contributing to a vibrant trading environment.

| Aspect | Market Makers | Market Takers |

|---|---|---|

| Role | Place buy/sell orders | Accept existing orders |

| Order Type | Use limit orders | Use market orders |

| Profit Mechanism | Earn from the spread between buy and sell prices | Pay fees to execute trades quickly |

| Market Impact | Stabilize price, increase volume | Cause price fluctuations |

| Example | Limit order: Sell 10 BTC at $41,000 | Market order: Buys 5 BTC at $41,500 |

Role

Order Type

Profit Mechanism

Market Impact

Whales As Investors

Some crypto whales play a crucial role as innovators within the cryptocurrency landscape by funding new projects or initiatives. For instance, when whales participate in Initial Coin Offerings (ICOs) or token sales, they provide essential capital that can help these projects develop their technologies and achieve their goals.

Case Study

Vitalik Buterin, co-founder of Ethereum, is an example of a whale who has contributed to innovation. His early investments and advocacy for Ethereum have led to its growth as a leading smart contract platform. By supporting various decentralized applications (dApps) built on Ethereum, he has helped foster an ecosystem that encourages innovation.

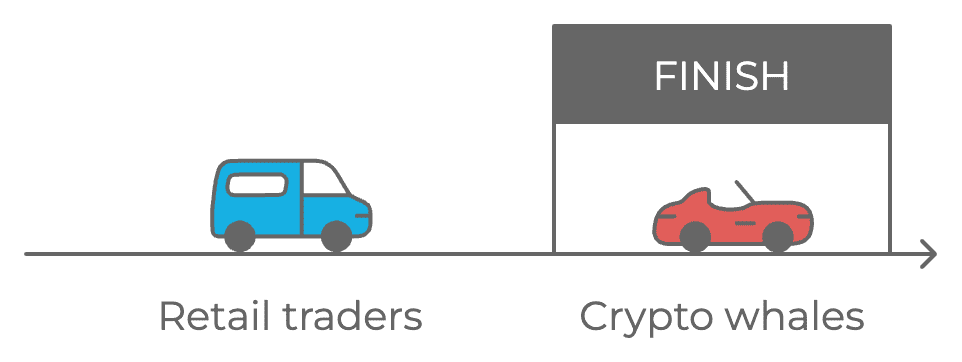

Whale Behavior Vs. Retail Behavior Investors

The behaviors of whales and retail investors differ significantly during periods of market volatility. Understanding these differences can help investors make more informed decisions.

| Aspect | Whale Behavior | Retail Investor Behavior |

|---|---|---|

| Decision-Making | Data-driven, strategic | Emotion-driven; impulsive |

| Market Influence | Large transactions cause significant movements | Follows whales; amplifies movements |

| Trading Strategies | Accumulation during dips; advanced strategies | Lacks sophistication; trend/FOMO-based |

| Risk Management | Hedging, diversification | Less experienced; unprepared for volatility |

| Example Scenario | Buys 5,000 BTC during dip, causing upward trend | Panics and sells 2,000 BTC, causing drops |

Decision-Making

Market Influence

Trading Strategies

Risk Management

The Impact of Whale Transactions on Different Types of Cryptocurrencies

Bitcoin Vs. Altcoins

Whale movements affect Bitcoin and smaller-cap altcoins differently, primarily due to their market characteristics.

| Aspect | Bitcoin | Altcoins |

|---|---|---|

| Market Capitalization | Largest market cap, greater stability | Lower market caps, higher volatility |

| Price Stability | Large transactions absorbed due to liquidity | Sharp price changes, lower liquidity |

| Volatility | Moderate volatility, stabilizes quickly | High volatility, drastic price swings |

| Market Depth | Deep market depth, minimal price impact | Shallow market depth, significant movement |

| Example of Whale Activity | Selling 1,000 BTC causes dip, recovers | Selling 100,000 altcoin leads to severe drop |

| Recent Trends | Accumulating as hedge against inflation | Diversifying leads to increased volatility |

Market Capitalization

Price Stability

Volatility

Market Depth

Recent Trends

Stablecoins and DeFi Tokens

Whale activities in stablecoins and DeFi tokens differ significantly from those in traditional cryptocurrencies due to factors like liquidity pools and staking mechanisms.

| Aspect | Liquidity Pools | Staking Mechanisms |

|---|---|---|

| Whale Activity | Whales provide assets for earnings | Whales lock up tokens for rewards |

| Market Impact | Large withdrawals can cause price changes | Large stakes can raise token prices |

In DeFi, whales often participate in liquidity pools, where they supply funds in exchange for earnings from transaction fees. If a whale withdraws a large amount of money, it can disrupt trading and affect the token's price.

Additionally, many DeFi tokens let whales stake their assets for rewards. When they stake a lot of tokens, it lowers the amount available in the market, which can drive up prices. However, if they unstake many tokens at once, it can flood the market and quickly drop prices.

How Crypto Whales Shape Market Dynamics?

Price Volatility

Large transactions by crypto whales can create significant price swings and liquidity issues in both rising and falling markets. When a whale executes a large buy or sell order, it can disrupt the balance of supply and demand, leading to noticeable price fluctuations.

- In Rising Markets: When a whale buys a substantial amount, it increases demand and can drive prices up. For example, if a whale purchases 10,000 BTC, other investors may view this as a bullish signal and rush to buy, further pushing the price higher.

- In Falling Markets: Conversely, if a whale sells a large portion of their holdings, it can flood the market with supply. For instance, a whale dumping 5,000 BTC might cause panic selling among smaller investors, leading to a sharp price decline as they rush to sell their assets to avoid losses.

Whale Strategies

Crypto whales use various strategies to maximize profits and influence the market. Here are some common ones:

- Accumulation: Whales buy assets during market downturns when prices are low. By purchasing large quantities at these lower prices, they grow their holdings while minimizing costs.

- Distribution: After accumulating enough assets, whales sell their holdings gradually when market sentiment is favorable. This strategy helps avoid sharp price drops that could occur if they sold everything at once.

- Pump and Dump: Whales buy large amounts of a cryptocurrency to artificially inflate its price. Once the price rises and attracts other traders, they sell off their holdings, leaving others with losses when the price crashes.

- Layered Buying: Whales place multiple small buy orders at different price levels to create an illusion of demand. This can encourage other traders to buy, pushing the price up.

- Stop-Loss Hunting: Whales often know where retail traders set their stop-loss orders. By driving the price down to these levels, they trigger stop-loss sales, adding downward pressure on the price before buying back at lower levels.

Market Manipulation or Stabilization?

Differentiating between whale manipulation and legitimate market-making activities is crucial for understanding their impact on market stability.

- Market Manipulation: This occurs when whales use tactics like pump-and-dump schemes or stop-loss hunting to create artificial volatility. For example, if whales band together to inflate a cryptocurrency's price through mass buying, then quickly sell their holdings, smaller investors can face substantial losses.

- Legitimate Market-Making: On the other hand, when whales hold onto their assets during market turbulence instead of selling, they help reduce selling pressure, which stabilizes prices. By providing liquidity through large buy or sell orders, they facilitate smoother trading for all market participants.

How to Track Whale Movements?

Tracking whale movements is essential for understanding market dynamics. Here are several blockchain analytics tools that can help investors keep tabs on large transactions.

Comparison of Blockchain Analytics Platforms

| Feature | Whale Alert | Glassnode | Nansen | Etherscan |

|---|---|---|---|---|

| Focus | Large transactions | On-chain data | Comprehensive analytics | Ethereum-specific |

| Key Features | Real-time alerts, cross-chain monitoring | Advanced analysis, metrics, APIs | Wallet analysis, smart contracts, NFTs | Transaction tracking, smart contract analysis |

| Target Audience | Traders, investors | Institutional investors, traders | Investors, teams | Traders, developers, enthusiasts |

| Strengths | Timely alerts, comprehensive data | Sophisticated analysis, metrics | In-depth insights, NFT analysis | Ethereum-specific focus, transaction details |

| Weaknesses | Limited to large transactions | Primarily Bitcoin and Ethereum | Can be complex for beginners | Limited to Ethereum |

1. Whale Alert

Whale Alert is a service that provides real-time alerts about large cryptocurrency transactions, helping traders monitor significant movements in the market. It continuously collects and analyzes millions of blockchain transactions, combining this data with off-chain information from various sources to create a comprehensive database.

Key Features

- Real-time Alerts: Instant notifications of substantial transactions.

- Comprehensive Data: A vast database of blockchain activity.

- Market Insights: Understanding trends and potential price shifts.

- Cross-Chain Monitoring: Tracking assets across different blockchains.

2. Glassnode

Glassnode is an on-chain market intelligence platform providing in-depth data and analytics for cryptocurrencies, especially Bitcoin and Ethereum.

Key Features

- Advanced On-Chain Analysis: Uncover market trends and turning points through sophisticated blockchain data analysis.

- Comprehensive Metrics: Access a vast library of metrics on exchange balances, transaction volumes, and investor behavior.

- Actionable Insights: User-friendly dashboards and customizable alerts help you capitalize on market opportunities.

- Powerful APIs: Integrate Glassnode data into your trading strategies with high-performance APIs.

3. Nansen

Nansen is a premier blockchain analytics platform offering in-depth insights for cryptocurrency investors and teams. Founded in 2019, it specializes in on-chain data analysis across multiple blockchains.

Key Features

- Comprehensive Wallet Analysis: Track wallet activity, identify trends, and make informed investment decisions.

- Smart Contract Insights: Analyze smart contracts for potential vulnerabilities and opportunities.

- NFT Market Intelligence: Gain insights into NFT trends, collections, and individual sales.

- Customizable Dashboards: Visualize key metrics and trends for a personalized experience.

4. Etherscan

Etherscan is a dedicated blockchain explorer for the Ethereum network, launched in 2015. It provides a comprehensive platform to explore and analyze Ethereum activities.

Key Features

- Transaction Tracking: Monitor Ethereum transactions in real-time.

- Smart Contract Analysis: Explore smart contract details, including transaction history and source code.

- Account Balance Monitoring: Check your Ethereum and token balances.

- Event Log Tracking: Access detailed information on smart contract interactions.

- Gas Price Tracking: Optimize transaction costs with real-time gas price data.

Whale-Watching Communities

Social media platforms are essential for tracking whale movements. Groups on Reddit and Telegram frequently post alerts about major trades, while dedicated Twitter accounts offer timely updates. By participating in these communities, investors can exchange insights and strategies about how whale activities influence the market. This collective knowledge helps traders stay informed and make better decisions.

Investor Tips for Dealing with Whale Activity

1. Interpreting Whale Signals

Retail investors can recognize whale activity by monitoring large transactions and observing price movements. Here are some ways to identify whale signals and their potential effects on trading decisions:

- Large Transactions: Monitoring significant transfers (e.g., 5,000 BTC) can signal whether a whale is selling or accumulating, prompting investors to reassess their positions.

- Price Movements: Large trades often cause noticeable price changes. A whale’s substantial buy may attract retail interest, while a significant sell can trigger panic.

- Short- and Long-Term Effects: Whale activity can create short-term volatility, but consistent accumulation may indicate long-term confidence in an asset's value.

2. Hedging Against Whale Movements

Retail investors can implement several strategies to mitigate risks associated with whale transactions:

- Diversification: Spreading investments across various cryptocurrencies reduces the impact of price manipulation by any single asset.

- Stop-Loss Orders: Setting these allows automatic selling when prices fall below a set level, helping to limit losses from sudden drops.

- Position Sizing: Limiting individual investments relative to the overall portfolio can help manage risk from significant price swings.

- Market Monitoring: Keeping an eye on unusual trading activity can provide early warnings of potential manipulation.

3. Building Resilience Against Manipulation

To avoid emotional trading decisions and protect themselves from potential pump-and-dump schemes orchestrated by whales, retail investors can adopt the following tips:

- Stay Informed: Keeping up with market news helps investors make informed decisions rather than reacting impulsively.

- Long-Term Focus: Emphasizing long-term goals can help mitigate the effects of short-term volatility caused by whale actions.

- Avoiding FOMO: Investors should be cautious about following trends driven by whales without conducting their own research.

- Community Engagement: Participating in online forums can provide valuable insights into market trends and whale activities.

The Future of Crypto Whales: Changing Dynamics

The Rise of DeFi and DAOs

Decentralized finance (DeFi) and decentralized autonomous organizations (DAOs) may reduce traditional crypto whales' influence. DeFi platforms increase accessibility for more users, while DAOs promote collective decision-making. This shift helps distribute power more equitably and allows smaller investors to engage in market dynamics.

New Types of Whales

New types of whales are emerging in the evolving crypto landscape. Whales may now control governance tokens in decentralized protocols, affecting decisions without centralized power. Additionally, institutional investors focused on environmental, social, and governance (ESG) criteria could reshape the market by prioritizing sustainable cryptocurrencies.

Regulation Could Shape Whale Behavior

Regulatory changes may significantly impact whale behavior in cryptocurrency markets. New transparency requirements could force large holders to disclose their activities, limiting manipulation. Regulations might also introduce measures to stabilize markets during whale-driven volatility, protecting retail investors from excessive risks.

Conclusion

Crypto whales, with their immense wealth and influence, have become a fascinating and often controversial topic within the cryptocurrency ecosystem. Understanding their behavior and strategies is crucial for any investor looking to navigate the complex world of digital assets.

While whales can create both opportunities and challenges, it's essential to approach the market with a rational mindset and avoid impulsive decisions driven by fear or greed. By staying informed, diversifying your portfolio, and employing sound investment strategies, you can mitigate the risks associated with whale-driven market movements and potentially benefit from their activities.