Introduction

In recent years, cryptocurrency has surged in popularity, attracting millions of investors with promises of huge profits. But beneath the surface of this booming industry lies a growing threat—an explosion of cryptocurrency scams preying on both new and experienced investors.

According to the FBI’s 2023 Cryptocurrency Fraud Report, over $5.6 billion was stolen by scammers last year, as fraudulent schemes become increasingly sophisticated and harder to detect. Whether it's Ponzi schemes, phishing attacks, or fake exchanges, scammers are constantly evolving their tactics to exploit unsuspecting victims.

This comprehensive guide uncovers 7 major cryptocurrency scams you need to watch out for in 2024. Backed by real-world case studies, you’ll learn how these scams operate, what warning signs to look for, and practical steps to protect your investments. By staying informed and vigilant, you can safeguard your financial future and confidently navigate the fast-changing world of cryptocurrency.

7 Types of Crypto Scams

The digital landscape is constantly evolving, and with it, so are the tactics used by crypto scammers. From fake investment opportunities to AI-powered scams, fraudsters have developed increasingly complex methods to exploit the unprepared. To safeguard your investments, it’s essential to familiarize yourself with the most common types of crypto scams.

Below, we break down seven major categories of cryptocurrency scams, each accompanied by real-life examples and practical tips to help you avoid becoming a victim. By understanding these strategies, you’ll be better equipped to recognize the red flags and protect your assets in 2024.

Comparison Chart: 7 Types of Cryptocurrency Scams

| Type of Scam | Key Characteristics | Notable Case Study | How to Avoid |

|---|---|---|---|

| Investment Scams | Promises of high returns with little risk, often via Ponzi schemes or rug pulls | BitConnect Ponzi Scheme | Be skeptical of "too good to be true" offers and thoroughly research investments. |

| Data Breach Scams | Exploits security flaws to steal crypto assets through flash loans or honeypots | Flash Loan Attack | Use secure platforms and avoid unknown smart contracts or suspicious links. |

| Extortion Scams | Involves threats of harm or blackmail, often through ransomware or sextortion | Ransomware Attacks | Keep your systems secure and avoid paying ransoms; back up your data regularly. |

| Phishing & Spoofing | Fraudsters impersonate trusted entities to steal personal or financial info | Phishing Emails & Websites | Verify all links and sources before providing any sensitive information. |

| Social Engineering | Scammers manipulate victims into giving up funds, often via romance or impersonation scams | Romance Scams | Be cautious of unsolicited contact and verify the identities of those you engage with. |

| Employment Scams | Fake job offers or recruitment pitches that trick people into sharing information or sending crypto | Fake Job Offers | Research employers before sharing personal or financial data. |

| AI-Powered Scams | Use of deepfake technology to impersonate individuals or manipulate video content | Deepfake Scams | Be critical of suspicious media and verify the authenticity of sources. |

1. Investment Scams

Investment scams are fraudulent schemes that deceive individuals into putting their money into fake or misleading investment opportunities, often promising high returns with little risk.

Case Study 1 : The BitConnect Ponzi Scheme

Imagine being told you could earn massive daily profits just by investing in the next big cryptocurrency sensation. BitConnect promised exactly that—huge returns with little effort. Flashy testimonials flooded social media, showing regular people supposedly making fortunes overnight.

The fear of missing out (FOMO) was intense, and investors rushed in, believing they'd found the golden ticket to financial freedom. BitConnect wasn’t just an opportunity; it was marketed as the future of wealth.But behind the scenes, BitConnect was hiding a dangerous truth.

🚨 What Happened?

BitConnect was a textbook Ponzi scheme. Instead of making actual investments or generating real profits, BitConnect used money from new investors to pay “returns” to earlier ones. This created an illusion of success. The more people who joined, the longer the scheme survived—until the inevitable collapse.For a while, everything seemed perfect.

Early investors bragged about their growing wealth, fueling even more hype. But when recruitment slowed down, the whole operation collapsed. In 2018, the platform shut down abruptly, wiping out $2 billion of investor funds, leaving thousands of people with nothing but the bitter taste of betrayal.

How Ponzi Schemes Work

How to Avoid Investment Scams Like BitConnect

Here are some practical tips to help you spot and avoid Ponzi schemes or similar investment scams:

Research the Company and Its Leaders: Always dig deep into a company’s background, especially its leadership. Do they have a solid track record? Check for any warnings from financial authorities or signs of legal trouble.

Looking for Transparency: Legitimate companies are open about how they operate. If you don’t understand how the money is made, don’t invest.

Verify Regulatory Oversight: Make sure the company is registered with relevant financial authorities. This adds a layer of protection and ensures some level of oversight.

Case Study 2 : The Squid Game Token Rug Pull

In 2021, the Squid Game Token scam shocked the crypto world, leaving countless investors reeling. Riding the massive popularity of the hit Netflix series "Squid Game," developers launched a cryptocurrency with the same name, hyping it up across social media. With promises of high returns and the excitement of a trending show, investors poured in, causing the token’s price to skyrocket.At its peak, the Squid Game Token hit a whopping $2,860 per token.

But just as quickly as it rose, it collapsed. The developers sold all their tokens at the peak price and vanished, taking millions of dollars from unsuspecting investors. The crypto community was stunned as they watched the token’s value drop to zero in an instant. This left thousands with nothing but the harsh lesson of what rug pulls are all about.

What Are Rug Pulls

How to Spot and Avoid Rug Pull Scams

Check Liquidity and Trading Volume: Make sure there’s enough liquidity and real trading volume. If it looks like only a handful of people are trading the token, or liquidity is low, it might be a setup for a rug pull.

Look for Community Engagement and Transparency: Healthy projects have engaged communities and clear, consistent communication from the team. Watch out for projects that lack a roadmap or utility and focus solely on hyping up the token price.

Case Study 3 : Fake Exchanges

Imagine logging into a website that looks exactly like your favorite crypto exchange. The layout, the colors, the interface—it’s all so familiar that you don’t think twice before depositing your hard-earned money.But what you don’t realize is that you’ve just walked into a scam. This was the case for many investors when a fraudulent Uniswap exchange popped up online, tricking users into believing they were using the real decentralized exchange (DEX).

Investors thought they were making legitimate trades, but as soon as they deposited their funds, the scammers disappeared—leaving behind empty wallets and shattered trust. By mimicking the design and functionality of the legitimate platform, these scammers made it nearly impossible for users to tell the difference. It was only when the funds were gone that victims realized they’d been duped.

What Are Fake Exchanges

How to Spot and Avoid Fake Exchange Scams

Here are some actionable tips to ensure you don’t fall for these convincing scams:

Double-Check URLs and Apps: Always verify the URL before logging in or depositing funds. Scammers often create websites with similar-looking domains (e.g., “uniswapp.com” instead of “uniswap.org”). Use trusted sources like official app stores or direct links from trusted communities.

Look for Reviews and Community Feedback: Before using any exchange, do a quick search for reviews and feedback from the crypto community. Platforms like Reddit or Twitter are great for spotting red flags and identifying whether a site has been reported as a scam.

2. Data Breach Scams

Data breach scams happen when hackers exploit data breaches to steal personal information like emails or financial details, then demand ransom to prevent its exposure. These scams prey on the fear of reputation or financial loss, pressuring victims into paying to avoid the fallout.

Case Study 1 : Flash Loan Attack

In 2020, a devastating flash loan attack hit the bZx DeFi platform, showcasing the speed and sophistication of this type of hack. Imagine this: within minutes, hackers took out a massive $10 million flash loan—no collateral, no lengthy process, just instant money. Using this borrowed ETH, they manipulated the market by creating artificial price swings across multiple exchanges.Once the price discrepancies appeared, the attackers swooped in and profited, all while ensuring the original loan was repaid.

The result? bZx and its users were left with significant losses as the platform's liquidity was drained. In the blink of an eye, the attackers walked away with huge profits, leaving the platform exposed to further vulnerabilities.This is the chilling reality of flash loan attacks: they exploit quick, unsecured loans to manipulate prices, allowing hackers to siphon off massive profits without a trace.

What Are Flash Loan Attacks

How to Avoid Falling Victim to Flash Loan Attacks

Flash loan attacks are fast and lethal, but there are ways to protect yourself:

Ensure the Platform Has Been Audited: Before trusting a platform, make sure it has undergone thorough security audits. Platforms that invest in security measures are far more resilient to attacks.

Understand DeFi Technology: The more familiar you are with the technology behind decentralized finance, the better you’ll be at spotting potential vulnerabilities. Keep up to date with the latest trends, and learn about the risks involved in using DeFi protocols.

Case Study 2 : Honeypot Scams

Imagine stumbling upon a vulnerability in a crypto platform that seems too good to be true. Your heart races—an opportunity to exploit a flaw and walk away with easy money. But as soon as you make your move, everything locks up. The funds you thought would be yours are now frozen, and your crypto account is under siege.

You’ve just been caught in a honeypot trap.This was the experience of many hackers when they encountered honeypot scams designed to lure and catch malicious actors. These schemes are like baited traps, making hackers believe they’ve discovered a hidden vulnerability in a platform. But instead of an open vault, they end up trapped with nowhere to run.

What Are Honeypot Scams

These traps often look like seemingly lucrative opportunities—flawed smart contracts, exploitable DeFi protocols, or even fake trading bots promising free money. But when hackers or even curious users engage with these contracts, they are sealed off from accessing the funds they hoped to steal.

🚫 Real-Life Example: The Too-Good-to-Be-True Smart Contract

A recent honeypot scheme involved a smart contract that appeared to have a bug allowing anyone to withdraw funds at will. Many greedy attackers, seeing a quick payday, jumped in to exploit this "loophole." However, the contract was designed to reverse the transaction midway, freezing the attacker’s wallet and exposing their details to the platform owners.

How to Spot and Avoid Honeypot Scams

Honeypot scams can be tricky to identify, but here’s how you can protect yourself:

Stick to Reputable DeFi Platforms: Use well-known DeFi platforms like Aave, Uniswap, or Compound, which have undergone rigorous security checks and are trusted by the community.

Verify Smart Contract Addresses: Make sure you’re interacting with the official smart contract address. Honeypot scammers sometimes clone legitimate contracts with tiny modifications to trap users.

3. Extortion Scams

Extortion scams involve cybercriminals using threats to force victims to pay money, often in cryptocurrency. These scams can range from ransomware, which locks you out of your data, to sextortion, where scammers claim to have compromising information about you.

Case Study 1 : Ransomware

In May 2021, a cyber shadow loomed over the United States as hackers launched one of the most devastating ransomware attacks in recent memory—the Colonial Pipeline attack. Imagine waking up to discover that a critical infrastructure system, responsible for transporting nearly 45% of the East Coast's fuel, has been compromised. Panic ensues as fuel supplies are disrupted, leading to long lines at gas stations and soaring prices.

The hackers demanded a staggering ransom of 75 Bitcoin, equivalent to about $4.4 million at that time. The situation escalated quickly, forcing Colonial Pipeline to make a difficult decision: pay the ransom to regain access to their systems and minimize further operational disruptions.

This incident was a wake-up call for industries worldwide, highlighting the vulnerabilities of critical infrastructure to cyberattacks. Ransomware, which locks users out of their systems until a cryptocurrency ransom is paid, can have catastrophic effects on both businesses and the public.

What is Ransomware

The Colonial Pipeline incident underscored the profound impact such attacks can have—not just on the targeted organization but on entire communities and economies. This attack didn’t just disrupt the pipeline; it led to panic buying, fuel shortages, and increased prices across the East Coast.

How to Protect Yourself from Ransomware

While ransomware can strike any organization, there are proactive steps you can take to reduce your risk. Here’s how you can protect yourself and your business:

Install Anti-Malware Tools: Use reputable anti-malware tools to detect and remove potential threats before they cause harm. Regularly scan your systems to identify any unusual activity.

Backup Your Data Frequently: Keep regular backups of your data on a secure, offline location. This ensures that even if you fall victim to a ransomware attack, you can restore your information without paying the ransom. Test your backups periodically to ensure they are functioning properly.

Case Study 2 : Sextortion Scams

Imagine checking your inbox to find a threatening email from an anonymous sender, claiming they have compromising photos or videos of you. Your heart races as panic sets in—what if the allegations are true? What if they really have evidence to ruin your life?Scammers leverage this fear, demanding payment in Bitcoin to prevent the release of the alleged material.

In many instances, the claims made by these cybercriminals are completely fabricated. Victims find themselves ensnared in a web of intimidation, often feeling isolated and desperate for relief.One case involved a victim who received an email claiming that their webcam had been hacked and that incriminating footage would be shared unless they paid a ransom.

Despite the absence of any such recordings, the emotional toll of the threat left the victim in turmoil. This is the essence of sextortion—using fear and manipulation to extort money from individuals by threatening to release sensitive information.

What is Sextortion?

The tactics employed by scammers are often similar:

- Fake claims of compromising material.

- Demands for payment to keep the alleged material private.

- A reliance on the victim’s fear to prompt an immediate response.

How to Protect Yourself from Sextortion

Report the Scam to Authorities: Immediately report any sextortion attempts to local law enforcement or cybercrime units. Document the email, including the sender’s address and the contents, as evidence.

Strengthen Your Cybersecurity Practices: Use strong, unique passwords for all your accounts to reduce the risk of hacking. Enable two-factor authentication (2FA) to add an extra layer of security, making it harder for unauthorized users to access your accounts.

Educate Yourself About Online Safety: Familiarize yourself with common scam tactics to recognize them quickly. Stay informed about how to protect your digital footprint and avoid oversharing personal information online.

4. Phishing & Spoofing

Phishing scams trick users into giving away sensitive information, such as login credentials or private keys, by using fake emails or websites that resemble legitimate ones. Scammers create urgency or fear to prompt victims to click malicious links or share personal details on fraudulent sites.

Case Study 1 : Phishing Emails & Websites

In the ever-evolving world of cryptocurrency, phishing scams are a pervasive threat that can ensnare even the savviest of users. One alarming incident involved scammers posing as technical representatives from Binance, one of the largest cryptocurrency exchanges globally. They crafted deceptively convincing emails that looked strikingly legitimate, creating an air of trust that led unsuspecting victims to a phishing site mimicking the official Binance login page.

As victims entered their login credentials, believing they were on the actual Binance platform, the scammers gained full access to their accounts. This allowed them to swiftly and discreetly steal funds, leaving victims unaware until it was too late.

What are Phishing Scams

How to Protect Yourself from Phishing Scams

Phishing scams can lead to significant financial losses, but there are effective strategies to protect yourself from falling victim:

Avoid Clicking Suspicious Links: Never click on links in unsolicited emails or messages. Instead, manually type the URL of the exchange or wallet into your browser, or use bookmarked links to ensure you’re accessing the legitimate site.

Enable Two-Factor Authentication (2FA): Activate 2FA on all your accounts. This additional layer of security can help protect your account even if your credentials are compromised.

Case Study 2 : Social Media Scams

In the age of social media, scams can spread like wildfire, leveraging the influence of trusted figures to deceive unsuspecting victims. One infamous incident involved scammers impersonating Elon Musk on Twitter. They launched a series of fake giveaways that promised to double any Bitcoin sent to a specific address.

Many users, enticed by the prospect of easy profits and the credibility of Musk’s name, fell victim to this elaborate ruse. They eagerly sent their Bitcoin, hoping for a windfall, only to discover that they received nothing in return.

What Are Social Media Scams

How to Protect Yourself from Social Media Scams

Verify Accounts: Check for official verification marks (like the blue checkmark) on social media profiles before engaging with any offers.

Do Your Research: Look up any claims made in promotions. Search for reviews, testimonials, or reports about the offer or the account.

Avoid Upfront Payments: Be wary of any promotion that requires you to send money or provide personal information upfront. Legitimate giveaways or investments do not typically operate this way.

5. Social Engineering Scams

Social engineering scams exploit trust to manipulate victims into sharing personal information or sending money. This includes confidence scams, where fraudsters build fake relationships, and government impersonation scams, where they pose as officials. Awareness of these tactics is key to protecting yourself.

Case Study 1 : Confidence/Romance Scams

In the digital age, love and trust can be easily manipulated. Confidence scams often start on dating apps or social media platforms, where scammers take their time to build trust and rapport with unsuspecting victims.After weeks of engaging conversations filled with sweet words and emotional connections, the scammer introduces enticing investment opportunities in cryptocurrency.

They claim to have uncovered secret methods to generate high returns. Many victims, feeling a genuine bond with their scammer, are drawn in, investing thousands of dollars based on these false promises.However, the moment the money is sent, the scammer vanishes without a trace, leaving the victim heartbroken and financially devastated.

What Are Confidence/Romance Scams

How to Protect Yourself from Confidence/Romance Scams

Avoid Sharing Personal Financial Information: Never disclose sensitive information, such as your bank account details or investment strategies, to individuals you have only met online.Protect your financial privacy as you would in real life.

Look for Signs of Manipulation: Be alert for urgency in investment requests, especially if the person is reluctant to meet in person. Scammers often create false crises to pressure their victims into making quick decisions.

Verify Their Identity: Try to verify the identity of your online acquaintance. Conduct a reverse image search on their photos or check their social media profiles for inconsistencies.

Case Study 2 : Government Impersonation Scams

Imagine receiving a phone call from someone claiming to be an IRS agent, threatening you with legal action over unpaid taxes on your cryptocurrency transactions. This scenario is all too real for many individuals who fall victim to government impersonation scams.In these scams, fraudsters cleverly pose as officials from government agencies to extract money or personal information from unsuspecting victims. One of the most common tactics involves impersonating IRS agents, demanding immediate payment via Bitcoin while instilling fear of legal repercussions if the victim fails to comply. This sense of urgency can overwhelm victims, pushing them to make hasty decisions without verifying the legitimacy of the claims.

What Are Government Impersonation Scams

How to Protect Yourself from Government Impersonation Scams

Be Wary of Immediate Payment Demands: Any demand for immediate payment or threats of legal action should raise a red flag. Remember, legitimate government agencies will not operate in this manner.

Research the Legitimacy: Before responding to any communication claiming to be from a government entity, always take time to research and confirm its legitimacy. Check official government websites or resources for guidance on how to handle such inquiries.

Trust Your Instincts: If something feels off about the communication, trust your instincts. Scammers often create high-pressure situations to manipulate victims.

6. Employment Scams

Employment scams prey on job seekers by promising enticing positions while demanding upfront payments for training or equipment. These schemes exploit people’s aspirations for a better future, making it vital to recognize the signs to avoid falling victim.

Case Study 3 : Fake Job Offers

Picture this: You come across a remote job listing that promises a lucrative salary paid in cryptocurrency. It seems too good to be true, but your hopes soar as you imagine the possibilities. However, as you dig deeper, you realize that this opportunity is nothing but a scam.

Fraudulent recruiters have increasingly targeted hopeful job seekers, luring them in with attractive offers that turn out to be empty promises. Victims are often required to pay upfront for “training” or essential equipment, leading them to believe that they are investing in their future. But once the money is sent, the scammers vanish, leaving the victim cut off from communication and with no job prospects.

What Are Fake Job Offers

How to Protect Yourself from Fake Job Offers

Research the Company Thoroughly: Before providing any personal information or money, take the time to research the company. Verify the job posting through official channels—check the company’s website or reputable job boards to confirm the listing is genuine.

Look for Red Flags: Be cautious of unrealistic salary offers or vague job descriptions. If the offer seems too good to be true, it likely is! Watch out for a lack of a formal interview process or pressure to make quick decisions.

7. AI-Powered Scams

AI-powered scams are becoming increasingly sophisticated, using deepfake videos and voice cloning to trick victims into transferring funds or making rash financial decisions. As these technologies evolve, staying informed is essential to protect yourself from these deceptive tactics.

Case Study 1 : Deepfake Scams

In an alarming incident that showcases the dangers of deepfake technology, scammers successfully cloned the voice of a well-known CEO to orchestrate a massive financial fraud. Imagine this scenario: a company's financial department receives an urgent call from what seems to be their CEO, instructing them to transfer millions in cryptocurrency to a new account. The employees, believing they are following legitimate orders, comply without hesitation.

However, this was not their CEO on the line. Instead, it was a sophisticated AI-generated imitation designed to mimic the CEO’s voice perfectly. The scammers had utilized advanced deepfake technology to create an eerily convincing audio clip, exploiting the trust and respect employees had for their leader.

What Are Deepfake Scams

How to Protect Yourself from Deepfake Scams

To guard against these sophisticated scams, consider the following practical measures:

Use Multiple Verification Channels: Before making any transfers, verify the request through multiple channels. Call the person directly using a known phone number rather than responding to the request. This step can help confirm whether the request is genuine.

Educate Yourself and Your Team: Knowledge is power! Familiarize yourself with deepfake technology and its implications. Conduct training sessions within your organization to raise awareness about the potential risks and how to identify deepfake scams.

Be Wary of Unsolicited Communications: Skepticism is your ally! Be cautious of any unsolicited emails or messages that request financial transactions. Double-check the sender’s information for any discrepancies or unusual signs.

Implement Security Protocols: Establish security protocols for financial transactions within your organization. Consider using multi-factor authentication and requiring verification from multiple personnel before processing large transfers.

Debunking 7 Myths About Cryptocurrency Scams

Cryptocurrency scams are often clouded by misconceptions that can mislead even seasoned investors. By dispelling these myths, we can highlight the realities of cryptocurrency scams and stress the importance of vigilance.

Myth 1: Only Inexperienced Investors Fall for Scams

Reality: It's a common belief that only those new to cryptocurrency investing can be misled by scams. However, the truth is that experienced investors can also be targeted, as they may become overconfident or complacent.

A California resident, referred to the fraudulent trading platform coobe.im, initially invested $200 and saw their balance soar to nearly $500,000. However, they were later asked to pay an additional 8% commission to withdraw funds, revealing they had been scammed.

Myth 2: All Cryptocurrency Investment Opportunities Are Legitimate

Reality: Many investors assume that if an investment opportunity appears on social media or through a referral, it must be legitimate. However, the cryptocurrency space is rife with fraudulent schemes.The Onecoin scam lured victims with promises of high returns, leading them to invest more after seeing initial profits. Ultimately, everything collapsed, leaving investors out of over $4 billion.

Myth 3: Free Money Offers Are Genuine

Reality: Offers that seem too good to be true often are. Scammers exploit people's desire for easy money by promising free cryptocurrency or unrealistic returns. Always be cautious of such claims, as they typically signal a scam designed to deceive victims.

Myth 4: You Can Trust Celebrity Endorsements

Reality: Celebrity endorsements can be misleading. Scammers have used deepfake technology or impersonated famous figures to promote fake investments, deceiving even savvy investors who may trust these endorsements without verification.

Myth 5: Only Online Transactions Are Risky

Reality: While many scams occur online, risks are not limited to the digital realm. Offline interactions can also pose significant threats. Victims may receive unsolicited investment offers via phone calls or in-person meetings, leading them to invest in fraudulent schemes. The Department of Financial Protection and Innovation has documented numerous cases where individuals were approached through various channels and convinced to invest in scams, illustrating that caution is necessary both online and offline.

Myth 6: If It Looks Professional, It Must Be Legitimate

Reality: Many investors mistakenly equate professionalism with legitimacy. Scammers often craft polished websites and marketing materials to create an air of credibility.For example, Fonnex.com presented itself as a legitimate exchange but locked users out after demanding exorbitant verification fees. This underscores that professional appearances do not guarantee legitimacy; thorough research is essential.

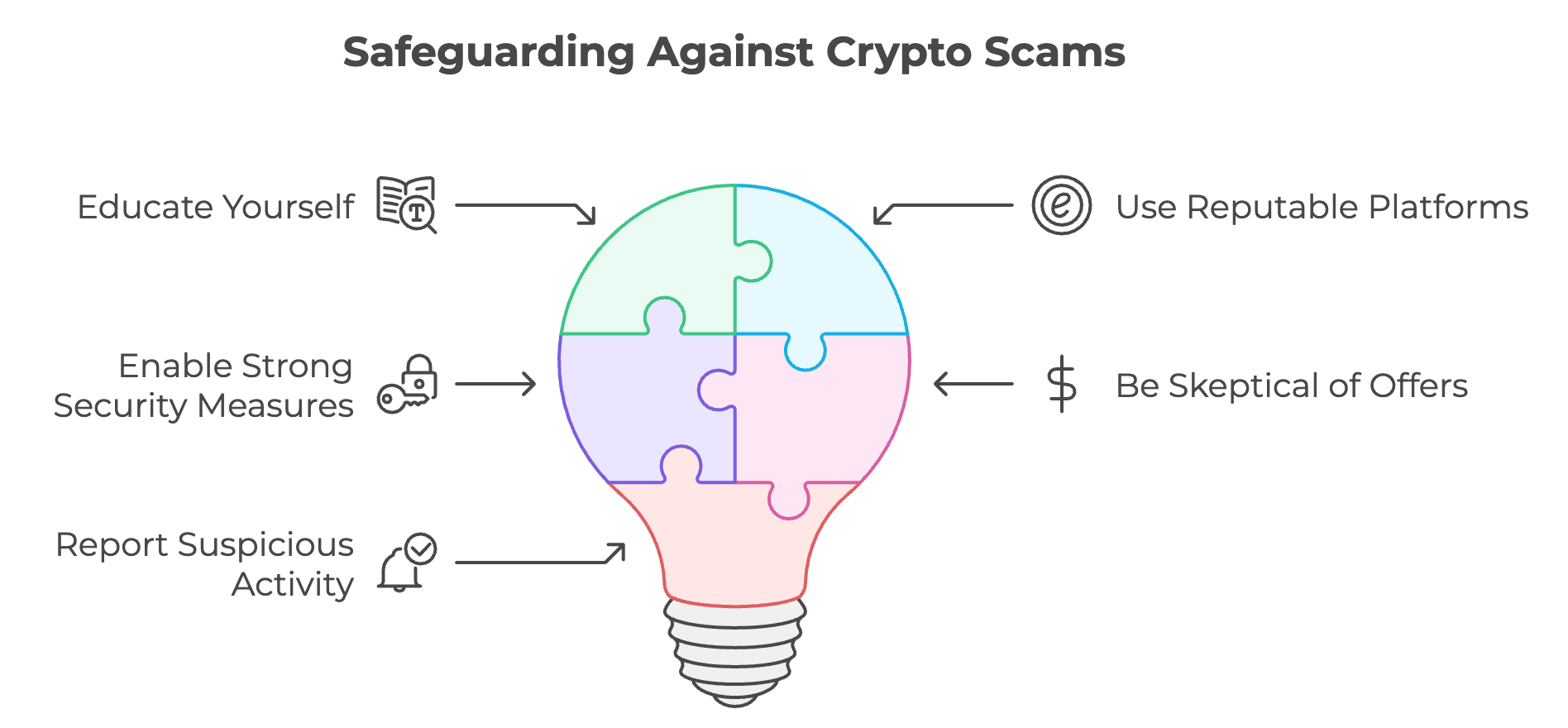

How to Protect Yourself from Crypto Scams in 2024?

As cryptocurrency continues to gain popularity, so do the tactics used by scammers. To navigate this evolving landscape safely, it's essential to adopt effective strategies and utilize new tools. Here are key measures you can take to protect yourself from crypto scams in 2024.

Educate Yourself

Staying informed about the latest scams and their tactics is your first line of defense. Familiarize yourself with common red flags, such as promises of guaranteed returns, requests for upfront payments, and unsolicited investment advice. Engaging with reputable sources, attending webinars, and participating in community discussions can help you stay updated on emerging threats.

Use Reputable Platforms

Always conduct transactions through established and reputable cryptocurrency exchanges. Scammers often create fake platforms that mimic legitimate ones to steal funds. Before investing, verify the platform’s legitimacy by checking reviews, ensuring it has proper security measures in place, and confirming its regulatory compliance.

Enable Strong Security Measures

Implementing robust security practices is crucial for protecting your digital assets. Use strong, unique passwords for your accounts and enable two-factor authentication (2FA) wherever possible. Additionally, consider using hardware wallets for storing significant amounts of cryptocurrency offline. Regularly update your software and be cautious when accessing your accounts over public Wi-Fi networks. Utilizing a Virtual Private Network (VPN) can help secure your internet connection against potential threats.

Be Skeptical of Offers

If an investment opportunity seems too good to be true, it probably is. Scammers often lure victims with promises of high returns or free money offers. Always approach unsolicited offers with skepticism and conduct thorough research before making any financial commitments.

Report Suspicious Activity

If you encounter suspicious activity or believe you have been targeted by a scam, report it immediately to the relevant authorities. Reporting scams helps law enforcement track criminal activity and may aid in recovering lost funds. Many countries have organizations dedicated to addressing fraud that can assist you in these situations.

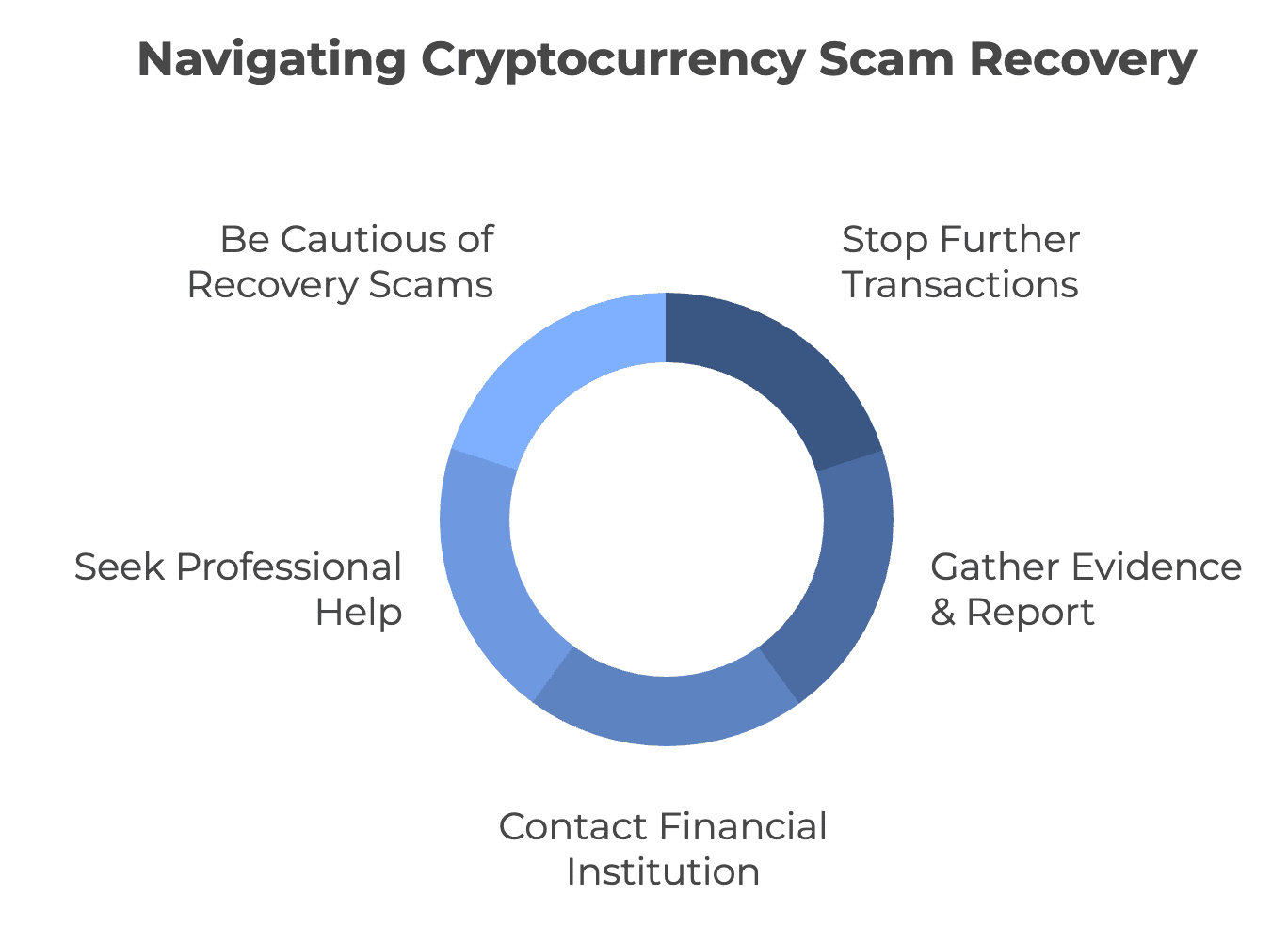

What to Do if You’ve Fallen Victim to a Crypto Scam?

If you’ve fallen victim to a cryptocurrency scam, it’s crucial to take immediate and strategic action to mitigate your losses and potentially recover your funds. Here’s a comprehensive guide on what to do next, along with an inspiring story of successful recovery.

1. Stop Further Transactions

Immediately cease all transactions related to the scam. This includes halting any ongoing trades or transfers that could lead to additional losses. Protecting your remaining assets should be your top priority.

2. Gather Evidence & Report the Scam

Collect all relevant information regarding the scam. This includes:

- Communication Records: Save emails, messages, and any correspondence with the scammers.

- Transaction Details: Document transaction IDs, amounts, wallet addresses, and dates.

- Screenshots: Take screenshots of any relevant websites or communications that can serve as evidence.

Report the incident to the appropriate authorities. This may include:

- Local Law Enforcement: File a report with your local police department.

- Regulatory Agencies: Contact financial regulatory bodies in your country (e.g., the FTC in the U.S., or your state’s consumer protection office).

- Cryptocurrency Exchanges: If you used a specific exchange, inform them about the scam to prevent further transactions involving your account.

3. Contact Your Financial Institution

If you used a bank account or credit card for the transaction, notify your financial institution immediately. They may be able to assist in reversing transactions or securing your accounts against further unauthorized access.

4. Seeking Professional Help

If significant amounts of money are involved, consider consulting with professionals who specialize in cryptocurrency recovery or legal advice regarding fraud cases. Be cautious of recovery services that ask for upfront fees, as many of these can also be scams.

5. Be Cautious of Recovery Scams

After falling victim to a scam, you might be approached by individuals or companies claiming they can help you recover your lost funds. Be wary of these offers; many are scams themselves. Always conduct thorough research before engaging with any recovery service and verify their legitimacy through independent sources.

Real Life Example of a Recovery

In June 2024, a landmark ruling from the High Court allowed Ms. Judith Sutton, who lost nearly £80,000 in a cryptocurrency scam, to recover her stolen funds. The elderly victim was deceived by a fraudster posing as “Michael Moore” on the Scrabble Go app, who convinced her to invest in a fake platform called "Cloudstaff," ultimately draining her life savings.

After realizing she had been defrauded, Ms. Sutton reported the incident to the police, who successfully traced the stolen assets to Binance, a leading cryptocurrency exchange. With the court's order for the delivery of her funds, Binance complied and returned her nearly lost life savings, highlighting the legal system's capacity to safeguard victims and hold scammers accountable.

Conclusion

In an era of booming cryptocurrency, the threat of scams has reached new heights, exemplified by the staggering losses reported by the FBI in 2023. As we've examined various tactics employed by fraudsters—from deceptive investment schemes to sophisticated deepfake fraud—it's clear that the stakes are high and the risks are very real.

By understanding these scams, you can spot red flags and protect your investments. The cryptocurrency landscape may be treacherous, but with vigilance and the insights shared in this guide, you can navigate it confidently. Remember, awareness is your best protection.